Dynamic Deception, Anderson and Smith (American Economic Review, 2014)

SEMINAR SLIDES for Dynamic Deception

This paper exploits the previously unnoticed fact that the continuous time insider trading literature initiated by Kyle (1985) solved in closed form what can be reinterpreted as a reputation problem by a long lived individual whose actions are partially observed. By bounding his trade sizes at unity, we find a precise analogue with a standard repeated game, albeit constant sum. In this game, the long lived layer eventually burns his tough guy reputation. By contrast, the repeated game literature has considered discrete time, and has only attacked this problem indirectly, and amazingly developed more than a decade later.

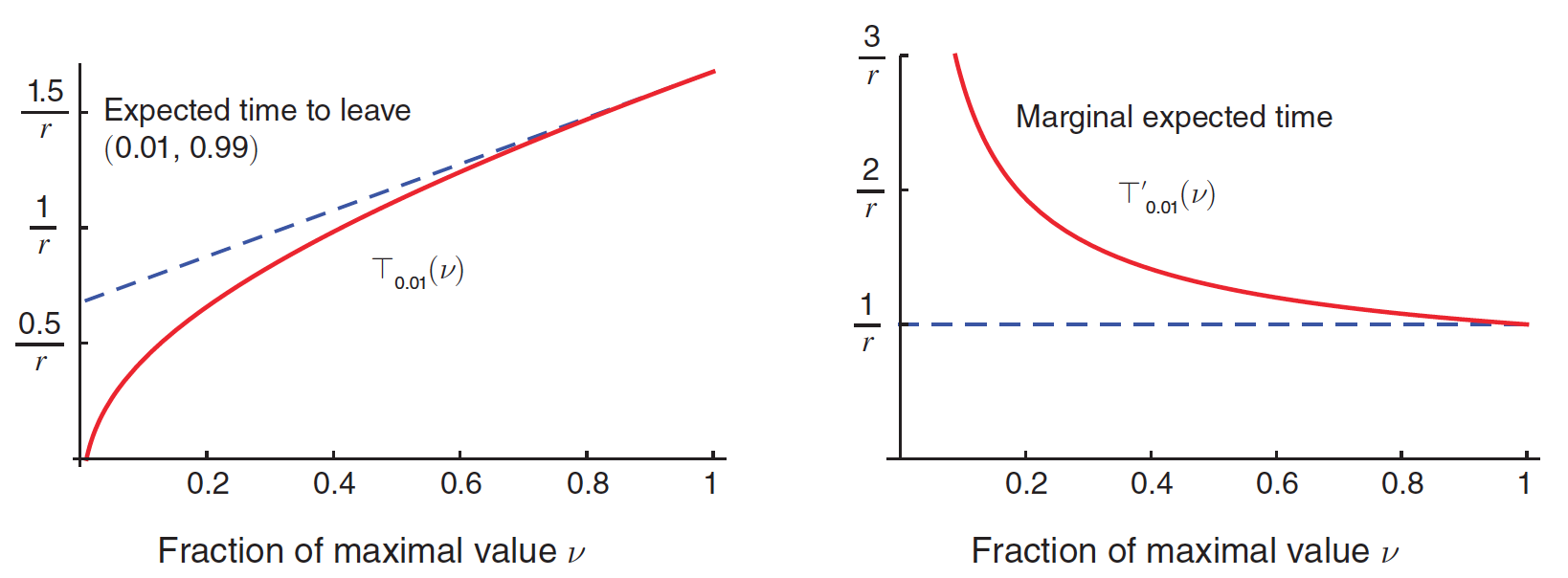

We characterize the unique equilibrium of a competitive continuous time game between a resource-constrained informed player and a sequence of rivals who partially observe his action intensity. Ournovel game adds two key assumptions for realism, namely, noisy monitoring and impatient players, to the classic paper by Aumann and Maschler (1966). We find a precise solution of the continuous time dynamic game. The intensity bound induces a novel strategic bias and serial mean reversion by uninformed players. We compute the duration of the informed player’s informational edge. The uninformed player’s value of information is concave if the intensity bound is large enough. Costly obfuscation by the informed player optimally rises in the public deception.

The most valuable commodity I know of is ‘information’. — Gordon Gekko (“Wall Street”, 1987)

“The art of using deceit and cunning grow continually weaker and less effective to the user.” — John Tillotson, Archbishop of Canterbury (1691–94)

Deception Duration

PS Our trade story might be seen as formalizing the legend of Rothschild’s dynamic sales operation of British consols [bank annuities] after learning of the British win at the Battle of Waterloo. This deception story seems to be the basis of the climactic final organge juice futures trading scene in “Trading Places” (1983). Four years later, “Wall Street” reworked this scene for its climactic near finale trading scene.